Irs Schedule E 2024 Worksheet

Irs Schedule E 2024 Worksheet – Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have .

Irs Schedule E 2024 Worksheet

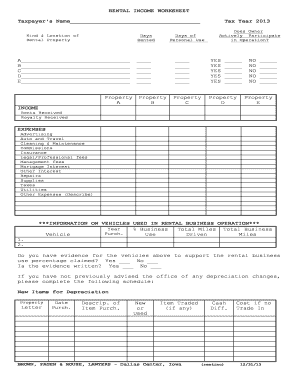

Source : www.signnow.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule e worksheet: Fill out & sign online | DocHub

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

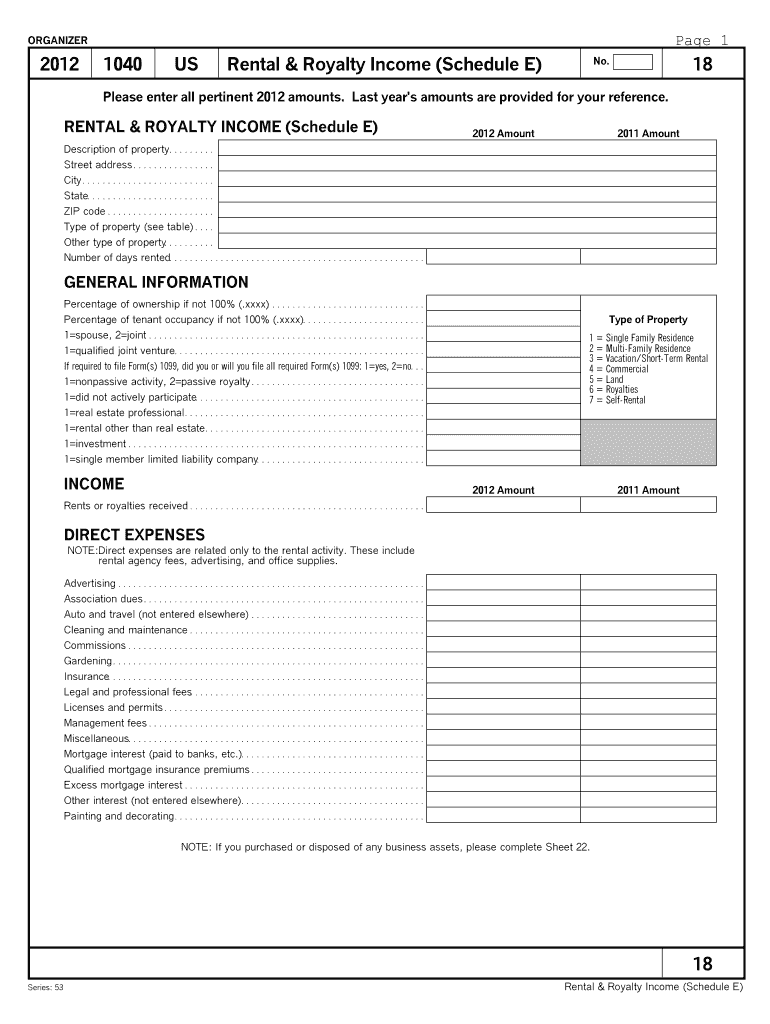

Source : www.irs.govSchedule e tax form: Fill out & sign online | DocHub

Source : www.dochub.comRental Property Income & Expenses Spreadsheet

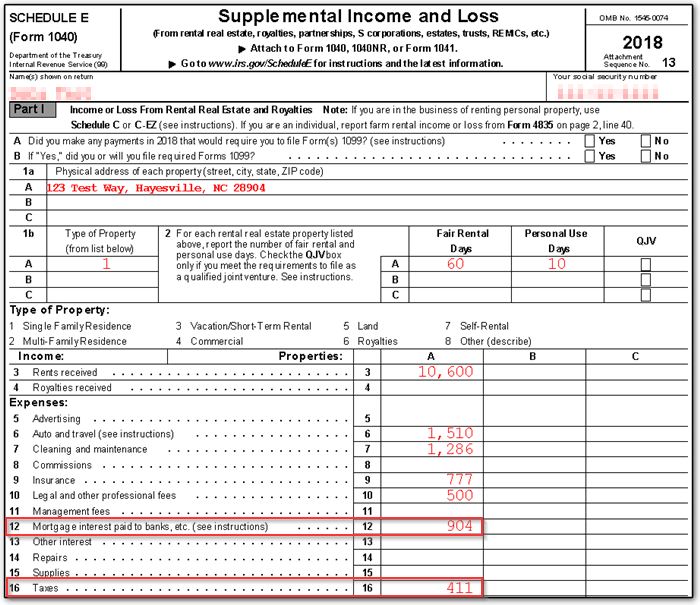

Source : www.fastbusinessplans.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 2024 Verification Worksheet Independent by Hofstra

Source : issuu.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov1040 Schedule E Tax Court Method Election (ScheduleA, ScheduleE)

Source : drakesoftware.comIrs Schedule E 2024 Worksheet Schedule E Worksheet Turbotax 2013 2024 Form Fill Out and Sign : This year’s tax filing numbers are starting to catch up to 2023’s statistics — with average refund amounts up over 2023. . 2024. Late returns are accepted via e-file until November. “Understanding the estimated tax refund schedule, being aware of delays related to specific tax credits, and using efficient tax-filing .

]]>