Home Deductions For 2024

Home Deductions For 2024 – Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax Cuts Are . Only one of these groups can take the home office deduction. Who Is Eligible for the Home Office Deduction? Under current federal law, you can qualify for the home office deduction only if you’re self .

Home Deductions For 2024

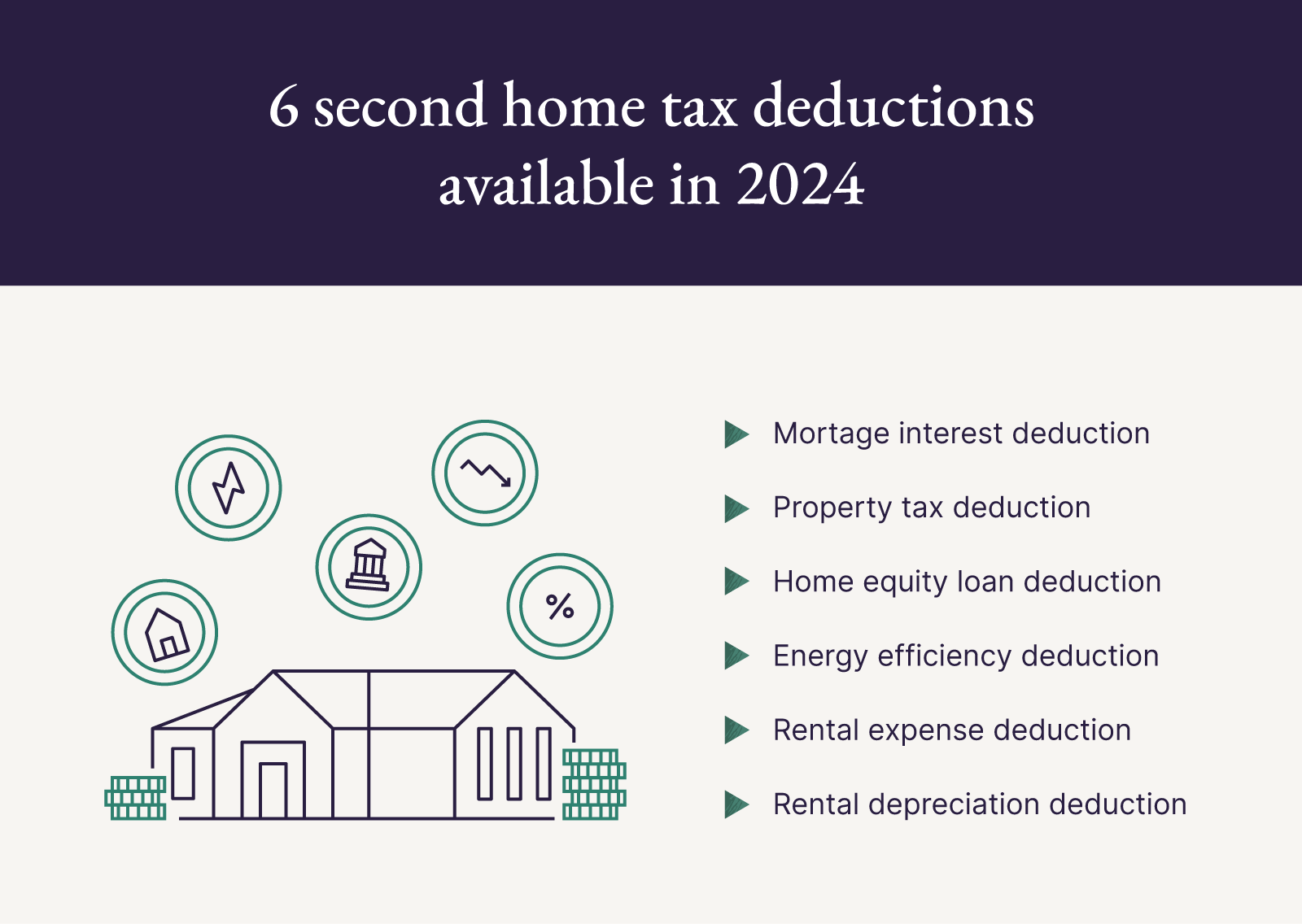

Source : www.cnbc.com6 Second Home Tax Deductions to Claim in 2024 Pacaso | Pacaso

Source : www.pacaso.com2024 Tax Tips: Home office deduction

Source : www.cnbc.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.comHome Office Deductions for 2024 | Alloy Silverstein YouTube

Source : www.youtube.com2023 and 2024 Work From Home Tax Deductions | SmartAsset

Source : smartasset.com6 Second Home Tax Deductions to Claim in 2024 Pacaso | Pacaso

Source : www.pacaso.comIRS raises tax brackets, see new standard deductions for 2024

Source : www.usatoday.comHome Office Deduction for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.comHow Working from Home Affects Income Taxes & Deductions (2023 2024)

Source : www.debt.orgHome Deductions For 2024 2024 Tax Tips: Home office deduction: the IRS lets you write off certain home office deductions for associated rent, utilities, real estate taxes, repairs, maintenance and other related expenses. 19. Educator expenses deduction If you . If you take out a home equity loan, you can deduct the interest on it depending on how you use it. According to the IRS, the interest is deductible if you use the money to make home improvements on .

]]>